Confidence slips marginally on geopolitical factors

Shipping confidence dipped very slightly in the three months to end-August 2018, according to our latest Confidence Survey.

The average confidence level expressed by respondents was down to 6.3 out of a maximum possible score of 10.0, this compared to the four-year-high of 6.4 recorded in May 2018. Confidence on the part of owners, however, was up from 6.6 to 6.8, equalling the highest level achieved by this category of respondent when the survey was launched in May 2008, with an overall rating for all respondents of 6.8 out of 10.0.

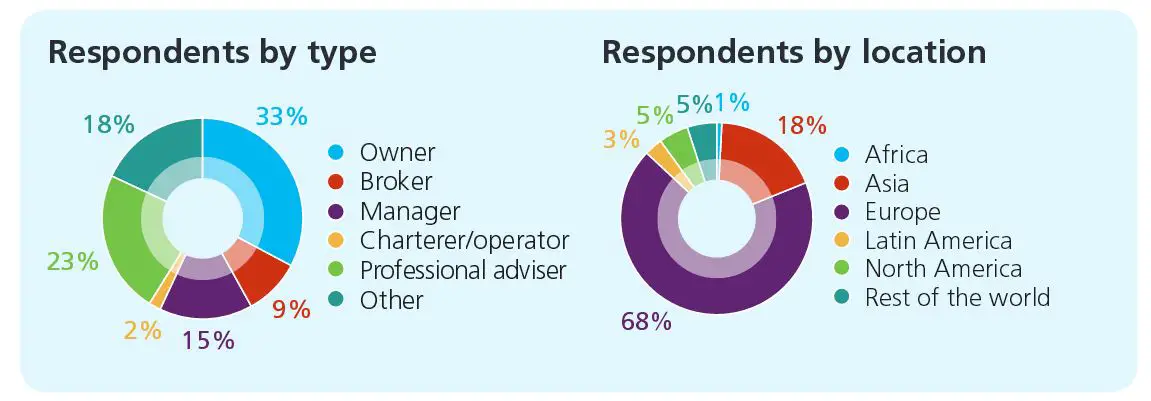

Confidence on the part of charterers was also up, from 6.7 to 7.0, the highest level for nine months. The rating for managers, however, was down from 6.7 to 6.2, and for brokers from 6.3 to 4.9. Confidence in Asia was up from 6.1 to 6.3, equalling the highest rating achieved over the past 12 months.

The likelihood of respondents making a major investment or significant development over the next 12 months was up from 5.2 to 5.5 out of 10.0. Owners’ confidence was up from 5.5 to 6.5, but charterers recorded a drop from 6.7 to 4.0. Expectations of major investments were up in both Asia (from 5.9 to 6.1) and Europe (from 4.8 to 5.3).

The number of respondents who expected finance costs to increase over the coming year was down to 59% from 63% last time. Owners (up from 64% to 70%) and charterers (up from 33% to 50%) expected such costs to increase, but managers (down from 65% to 45%) and brokers (down from 75% to 71%) were of the opposite opinion.

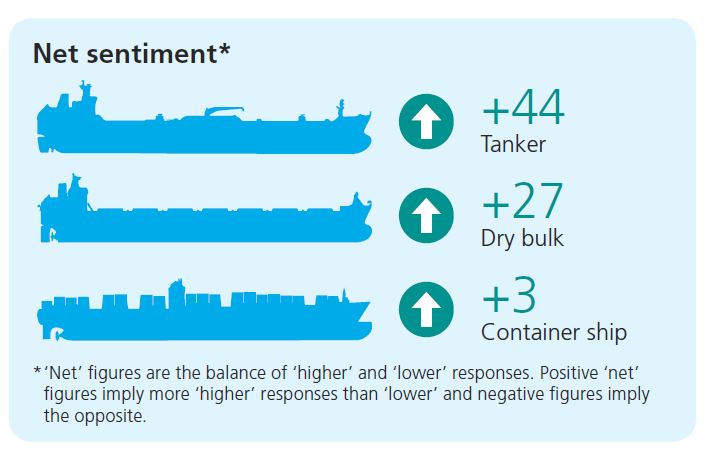

The number of respondents expecting higher rates over the next 12 months in the tanker trades was up by 3 percentage points to 53%. In the dry bulk sector, there was a 16 percentage-point fall, to 38%, in the numbers anticipating higher rates, while the numbers expecting higher container ship rates fell from 43% to 26%. Net sentiment in the tanker sector was +44, in the dry bulk trades +27, and for container ships +3.

Demands trends were identified by 28% of respondents as the factor likely to influence performance most significantly over the coming 12 months. Competition (23%) was in second place, followed by finance costs (17%).

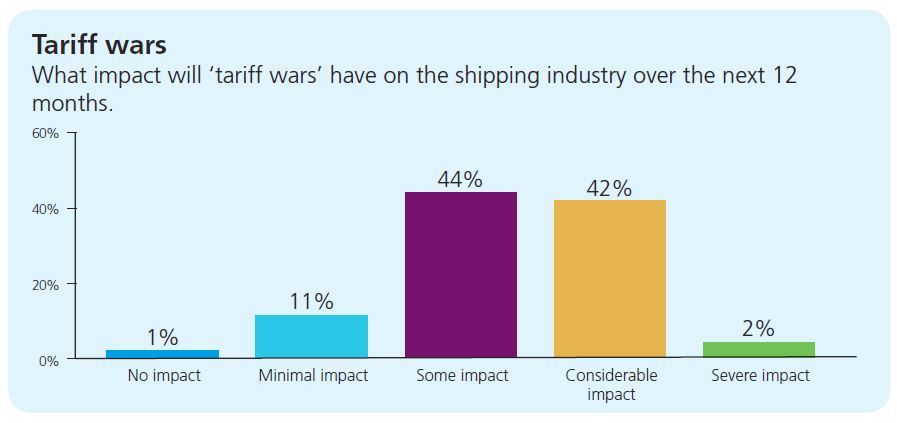

In a stand-alone question, 44% of respondents said they expected tariff wars to have “some” impact on the industry over the next 12 months. Meanwhile, 42% categorised such impact as “considerable,” and 11% felt that it would be “minimal”.

Richard Greiner, Partner, Shipping & Transport, says, “A small dip in confidence is not the news the industry wanted to hear, but confidence remains at its second-highest level for four-and-half years. Moreover, it is significant that the confidence of both owners and charterers actually increased.

“Concerns about geopolitical factors dominated the comments from respondents. These were led by President Trump’s efforts to transform US trade relations, but also included state support for shipping in China and South Korea. Shipping will always stand to reap the benefits of its global identity and presence, but will also court the risks that this must inevitably embrace.

Fortunately, shipping is accustomed to playing on the big stage, against a volatile backdrop and to a demanding audience. The Baltic Dry Index is up on a year ago and oil prices are on the rise. These and other positive portents encourage the belief that shipping is starting to recover, albeit slowly, from a ten-year downturn.

Press release: https://www.moorestephens.co.uk