Hafnia Tankers’ Shareholders to Decide on Merger with BW in January

On January 10, 2019, an extraordinary general meeting will be held in Malmö, Sweden, during which Hafnia shareholders will consider, and if thought fit, approve, a plan of merger.

Hafnia Tankers signed a merger agreement with BW Tankers on December 21, 2018.

Under the plan, BW Tankers intends to acquire Hafnia’s assets and liabilities, contracts, rights and obligations. The shareholders of Hafnia will in the merger receive consideration for their Hafnia shares in the form of common shares of BW Tankers Limited.

The merger agreement follows the BW Group’s acquisition of an additional 36.3 pct stake in Hafnia Tankers back in July 2018, bringing the company’s total ownership stake in Hafnia to 43.5 pct.

Related: Hafnia Tankers, BW Tankers Looking into Merger

Explaining reasons for the potential merger, Hafnia Tankers said: “The management team and board believe in a future rise in freight rates across the markets in which Hafnia operates, which will in turn lead to an uplift in both valuation and institutional investor interest in the business… the combination of Hafnia and BW Tankers is the best way to meet the future developments in the market.”

“The management team expects that there will be a number of important synergies to be achieved with the combined platform, including improved terms for financing, global commercial platform with chartering teams in Singapore, Houston and Copenhagen and increased efficiency with both in-house technical (from BW Tankers) and use of third party providers,” the company added.

The combined company will have a fleet active across all relevant segments and will be one of the largest pure-play product tanker businesses in the world with a fleet of 86 vessels (including newbuilds and excluding sale and leaseback vessels).

Press Releases: BW Tanker

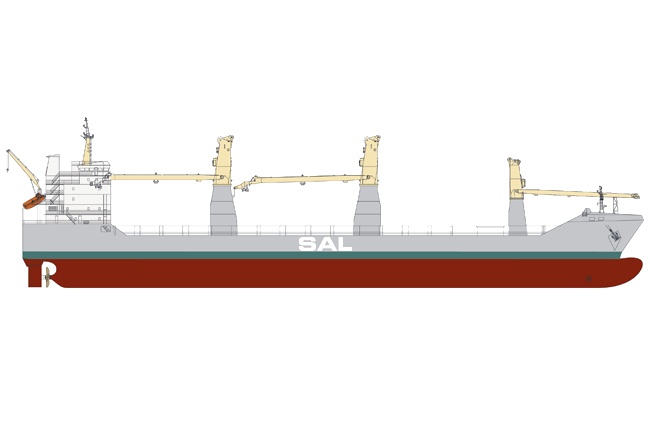

Photo Courtesy: BW Group